“Transforming India’s Semiconductor Industry: A Vision”

Boosting Domestic Production: India’s Ambitious Vision for Semiconductor Industry The Indian government has set its sights on developing a thriving semiconductor industry, as part of its larger vision for a self-reliant, technologically advanced economy. The semiconductor industry is a key driver of innovation and technological progress, providing the backbone for a wide range of devices […]

Boosting Domestic Production: India’s Ambitious Vision for Semiconductor Industry

The Indian government has set its sights on developing a thriving semiconductor industry, as part of its larger vision for a self-reliant, technologically advanced economy.

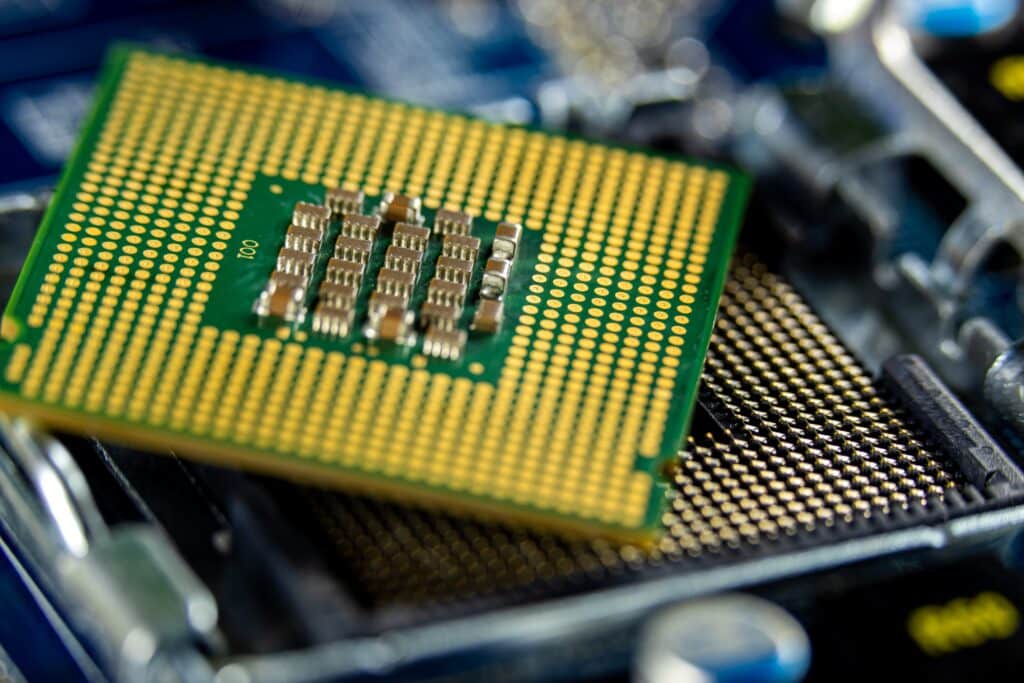

The semiconductor industry is a key driver of innovation and technological progress, providing the backbone for a wide range of devices and applications, from smart phones and laptops to self-driving cars and smart cities.

India’s current share in the global semiconductor market is less than 2%, with most of the chips used in the country being imported from other countries.

This puts India at a significant disadvantage, as it not only adds to the country’s import bill but also hinders its ability to develop cutting-edge technologies that are critical to national security and economic competitiveness.

To overcome these challenges, the Indian government has taken several steps to promote the growth of the semiconductor industry in the country.

One of the key initiatives is the creation of the National Policy on Electronics (NPE), which aims to make India a global hub for electronics manufacturing and design.

The policy sets an ambitious target of achieving a turnover of $400 billion in the electronics sector by 2025, with a significant portion of this coming from the semiconductor industry.

The government has also launched several schemes and programs to incentivize the setting up of semiconductor fabs (fabrication facilities) in the country.

The Semiconductor Fabless Accelerator Lab (SFAL) is one such program that aims to promote the growth of fabless semiconductor companies in India.

The SFAL provides funding, mentorship, and access to state-of-the-art fabrication facilities to startups and entrepreneurs working in the semiconductor space.

Another key initiative is the Production-Linked Incentive (PLI) scheme, which provides financial incentives to companies that invest in setting up semiconductor fabs in India.

The PLI scheme offers incentives of up to 25% of the incremental sales of semiconductor devices manufactured in India, over a period of five years.

The scheme has already received an enthusiastic response from leading semiconductor companies, with Intel, Samsung, and Micron among those expressing interest in setting up fabs in India.

In addition to these initiatives, the government is also focusing on developing the skills and expertise required to support a thriving semiconductor industry.

The Skill India program aims to provide training and upskilling opportunities to young Indians in areas such as electronics design and semiconductor manufacturing.

The government has also launched the Electronics Manufacturing Clusters (EMC) scheme, which provides infrastructure and other support to electronics manufacturing companies, including those in the semiconductor space.

These initiatives have already started to bear fruit, with several semiconductor companies setting up operations in India in recent years. In 2020, Intel announced a $20 billion investment to set up two fabs in India, which would manufacture cutting-edge semiconductor chips for use in devices such as 5G smartphones and autonomous vehicles.

Samsung also recently announced plans to invest $10 billion in setting up a fab in India, which would manufacture smartphone and other electronic components.

The growth of the semiconductor industry in India is not only important for the country’s economic development but also for its strategic interests.

India is currently heavily reliant on imports for critical technologies such as 5G, AI, and quantum computing, which are essential for national security and competitiveness.

A robust semiconductor industry in India would not only reduce this dependence but also allow the country to develop its own cutting-edge technologies and become a global leader in innovation.

Let’s now look at chip demand and Indian production per sector.

By application, servers, data centers and storage lead, followed by wired and wireless infrastructure, industrial electronics, automotive, consumer electronics, personal computing, and smart phone.

Looking at semiconductor value chain in India, it’s strengths include manufacturing equipment, raw materials, and R&D.

As the demand for semiconductors continues to increase worldwide, international cooperation has become more critical than ever.

To ensure a stable supply chain and prevent disruptions, it is essential to prioritize information exchange for monitoring semiconductor production, as well as early-warning mechanisms to address and prevent supply chain disruptions.

Collaboration in research and development of semiconductor technologies that combine complementary competencies is also crucial.

Additionally, exploring synergies for international standardization, including trusted chips and green technologies, can lead to a more sustainable and secure semiconductor industry.

By prioritizing these areas of cooperation, the global semiconductor industry can continue to grow and meet the demands of a rapidly changing market.