India’s domestic electric vehicle sales will cross 10 million by 2030, at CAGR of 49%

India’s EV Market: 49% CAGR Propels Domestic Electric Vehicle Growth It will be between 2022 and 2030,with 10 million annual sales by 2030, as per the Economic Survey 2023. At the COP26 summit, India pledged to achieve net-zero emissions status by 2070 and to lower its emission intensity by 45% from 2005 levels by 2030. […]

India’s EV Market: 49% CAGR Propels Domestic Electric Vehicle Growth

It will be between 2022 and 2030,with 10 million annual sales by 2030, as per the Economic Survey 2023. At the COP26 summit, India pledged to achieve net-zero emissions status by 2070 and to lower its emission intensity by 45% from 2005 levels by 2030.

EVs could help realize these goals and play a pivotal role in India’s green transition. India’s adoption of electric vehicles is hampered by the lack of significant charging infrastructure. However, the government is looking forward to developing a nationwide charging infrastructure network.

Adequate investments must be made by the manufacturers and emphasis should be given to the Research and Development (R&D) so that innovative methods of EV manufacture, battery disposal, battery use, and extraction of minerals required for EV batteries should be established to minimise any footprint left by EV adoption on the environment.

The proactive measures taken by the Government, as well as the State Government to accelerate EV transition, development of local manufacturing of batteries, and increasing affordability of the vehicles, augur well for the sector which is anticipated to see long-term growth in the future.

The overall outlook for EVs in India is positive, and the country is well on its way towards achieving a sustainable and eco-friendly transportation ecosystem.Electric Vehicles (EVs) penetration in India is still in its nascent stage. The move towards green energy is leading to soaring EV sales in India.

The underlying intent for the adoption of EVs is rooted in clean environmental practices and Original Equipment Manufacturers (OEMs) are adopting policies to ensure that the EV adoption process is aligned with the goal of an emission-free environment.

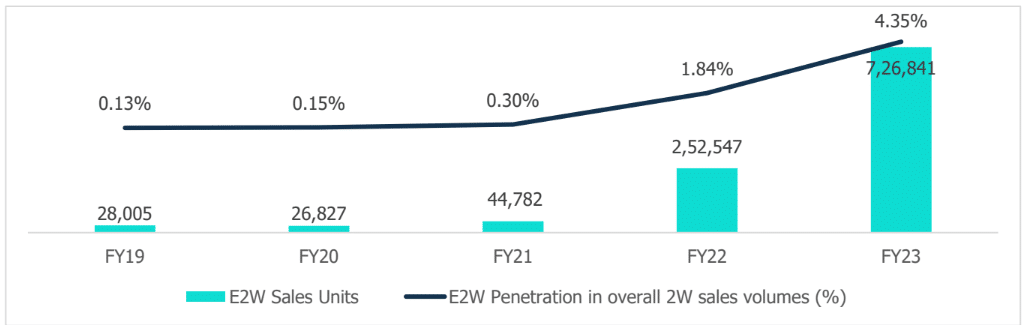

The electric two-wheelers (E2W) segment has witnessed significant growth over the years and currently it comprises around 62% of total EV sales in FY23. E2W sales in FY23 grew by 188% compared to the previous year.

The CAGR of E2W during the period FY19 to FY23 stood at 92%. This increase in sales can be attri-buted to the shift in customer preference towards EVs owing to government subsidies and tech- nological developments, lower running costs, low maintenance charges, and growing sensitivity towards the environment.

According to analysts, “Favorable state government policies coupled with central schemes have aided increasing penetration of EVs in states like Delhi and Maharashtra.

These states are also relatively better placed in terms of the availability of charging stations, though still far behind in terms of the actual requirements. Delhi, Maharashtra, Haryana, UP, Delhi, and Punjab have the most holistic EV policies while Arunachal Pradesh, Manipur, Himachal Pradesh, Ladakh, Kerala, and Uttarakhand’s policies are the least comprehensive.

Going forward, continued government thrust in terms of incentives and setting up charging infrastructure along with new model launches by major players is likely to drive EV adoption in India which will help the country in achieving a sustainable and eco-friendly transportation ecosystem.”

E2W leading the way in green mobility

The E2W (Electric 2-wheeler) sales in India have witnessed significant growth over the years. E2W sales grew by 188% in FY23 as compared to the previous year FY22.

The sales of low-speed E2W are higher as compared to high-speed E2W. Further, in the electric two-wheeler segment, electric scooters have been a favourite choice for consumers so far, accounting for the majority of sales.

However, numerous launches are expected in the high- speed electric motorbike market, especially from the established players in the coming years which will provide impetus to this segment.

The E2W sales continued to soar in FY23 which can be attributed to the shift in customer preference from petrol two-wheelers to electric ones due to competitive prices (owing to government subsidies and technological developments), lower running costs, low maintenance charges, and growing sensitivity towards the environment.

The increase in demand is primarily due to the government’s support through various incentives offered under the FAME-II scheme (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles).

Under the FAME-II scheme, the incentives for E2Ws have been increased from Rs. 10,000/kWh to Rs. 15,000/kWh, and the cap on incentives has gone up from 20% to 40%.

In addition, many states are offering additional subsidies & other incentives such as waiving off registration fees and road tax for electric vehicles. However, there was some impact on E2W sales in FY23, due to the withholding of subsidies under FAME II for not complying with Phased Manufacturing Programme (PMP) guidelines under the scheme.

The industry has received good government backing over the last few years to increase EV penetration in India. The initiatives taken by the central government and the states to speed the EV transition, promote local battery production, and increase electric vehicle affordability augurs well for the sector.

The EV two-wheeler segment penetration within the total Indian two-wheeler market is around 4% in FY23. On the other hand, the E2W segment contributes approximately 62% of the total EV market sales.

The E2W technology has now matured to a significant level and many manufacturers have entered the market with saleable products.

In terms of various categories of vehicles, the two-wheeler segment is most promising because the prices of E2Ws have become competitive with that of traditional counterparts in recent times due to supporting policies of the Government of India.

Such vehicles can also be served by relatively low-power chargers and the growth trajectory of this industry appears to be promising.

Few state policies have comprehensive designs which balance E2W sales, manufacturing, and overall ecosystem growth. The increasing number of public charging stations is expected to be driven by a range of players, such as pure-play charge points operators, oil marketing companies, utilities, and EV fleet operators.

The public sector oil companies such as IOCL, HPCL, and BPCL also plan to set up EV charging facilities. In addition to that, a host of private sector companies and start-ups have recently ventured into the business of electric vehicle charging.

Delhi, Maharashtra, Haryana, Uttar Pradesh, Delhi, and Punjab have the most holistic EV policies while Arunachal Pradesh, Manipur, Himachal Pradesh, Ladakh, Kerala, and Uttarakhand’s policies are the least comprehensive.

As per the Society of Manufactures of Electric Vehicles, the demand incentives are given under the Faster Adoption and Manufacturing of (Hybrid and) Electric Vehicles in India (FAME) scheme phase-II till October’22 for E2Ws is Rs. 2,464 Cr. approx. which is further supporting the growth.

Electric two-wheelers are also becoming more popular, as many low-speed category models are exempt from RTO registration and driving license requirements. E-scooters witness higher sales than e-motorcycles due to lower upfront costs and the availability of more models in the market, which provide ample options for buyers, further driving its adoption.

One of the critical drivers of growth is the rise of numerous brands in the E2W space, such as Ather, Ola, Hero Electric, Bajaj, TVS, Okinawa, Pure EV, and Revolt. More options are pushing better adoption across price points.

As a result, electric two-wheeler sales across India are on the rise, including in Tier 3 and Tier 4 cities. The daily commuter and heavy users save substantially with the advantage of lower cost of ownership, making E2Ws the right choice for players such as food aggregators and last-mile delivery partners.

The total cost of ownership can be lower by over 50% compared to an ICE vehicle. Limited range, and poor charging infrastructure plague India’s 2W market. Despite strong market tailwinds, challenges remain for faster adoption of E2W: from both the demand and supply side.

The primary challenges faced by electric two-wheeler users in India were poor battery charging infrastructure, limited top speed, unavailability of prompt support network, less range and poor build quality.

More Focus Needed to Remove Speed bumps to Accelerate EV Adoption

There are many roadblocks in the Indian market that is preventing the wide- spread adoption of electric vehicles.

The Indian government is continually seeking to stimulate the use of electric vehicles by decreasing the cost of gasoline imports and improving air quality by providing subsidies and other incentives although sales of these electric vehicles are increasing, there are several issues impacting the growth of EVs.

India’s adoption of electric vehicles is hampered by a large gap and a lack of significant charging infrastructure. Despite significant growth in the number of public charging stations over the last year, India still has a long way to go to achieve its goals.

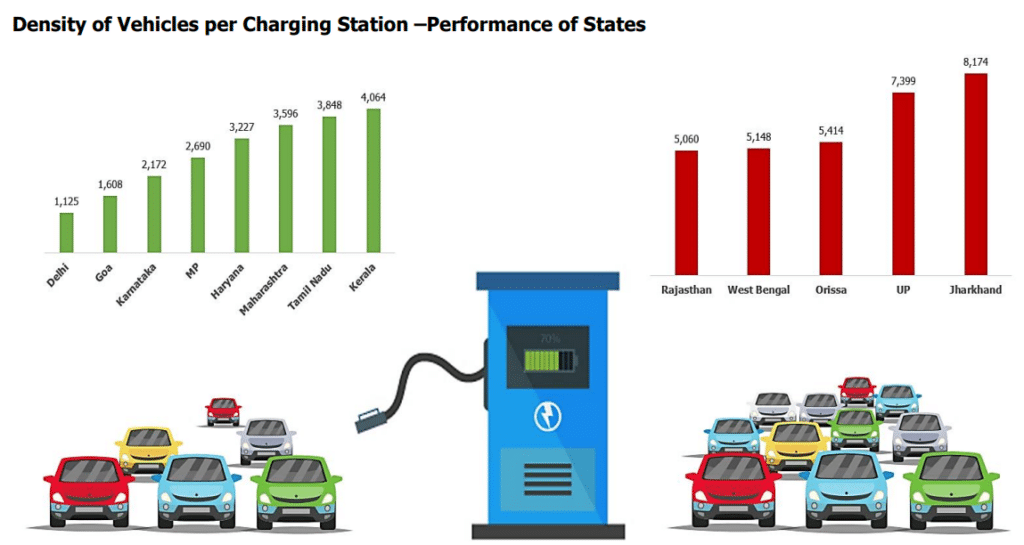

As of January 2023, India had 5,254 public electric vehicle (EV) charging stations, to cater to a total of 20.65 lakh EVs. Till date, the FAME II program has provided subsidies of Rs. 10 billion to develop almost 2,900 charging stations across 25 states.

As of January 2023, Delhi has the maximum number of vehicles per charging stations, followed by Goa and Karnataka. The gaps need to be addressed through better regulation, improved monitoring, mechanisms, and capacity building across the policy value chain.

The Ministry of Power revised its guidelines and standards for EV charging infrastructure. The revisions included easing provisions for EV owners to charge at home/office using existing electricity connections, a revenue-sharing model related to land use to make charging stations more economical, guidance on providing affordable tariffs, timelines for connectivity of charging stations to the grid, and a fixed ceiling on service charges for electricity.

The government has also been focusing on Battery Swapping Policy. The policy would initially focus on battery swap services for electric scooters, motorcycles, and three-wheeled auto-rickshaws, which may help in increasing the deployment of EVs for last-mile delivery and ride-sharing.

EV drivers can use battery swapping to replace discharged batteries with freshly charged ones at swap stations. This is faster than charging the vehicle and relieves drivers of range anxiety.

The battery is the most expensive component in an EV, switching it allows companies to offer it as a service via lease or subscription models which would help in lowering the cost of owning and maintaining the EV.

Due to import dependency, many EV manufacturers are importing Lithium and lithium-ion, further not complying with the Make-in-India initiatives. Lithium-ion batteries are the most popular and commonly used energy source for electric vehicles.

India does not have enough lithium reserves for manufacturing lithium-ion batteries and almost all-electric vehicles in the country run on batteries imported mostly from China, which is the largest producer.

As a result, all manufacturers import cells and battery packs. India’s heavy dependency on imports for electric vehicle batteries has resulted in exorbitant prices for these vital components, and eventually, the high cost of electric vehicles.

In recent years, flex-fuel vehicles and other CNG, biogas, and ethanol vehicles have gained prominence aided by favourable running costs, improving penetration of dispensing stations across the country, and enhanced product offerings by original equipment manufacturers (OEMs). E20 fuel is a blended fuel that contains 20% ethanol and 80% gasoline.

India has advanced the target date for achieving 20% ethanol-blending in petrol by five years by 2025.

With the exemption of basic customs duty of denatured ethyl alcohol, the government plans to support and boost ethanol production. In January 2023, the Society of Indian Automobile Manufacturers (SIAM) also signed a memorandum of understanding (MoU) with the US Grains Council toward the promotion of higher ethanol blends in the Indian gasoline mix.

The cost savings offered by Compressed Natural Gas and Liquified Petroleum Gas (LPG, often referred to as Autogas) in comparison to petrol and diesel, supported by increasing infrastructure support for fuel stations, will lead to favourable demand for Internal Combustion Engine based automobiles.

However, the demand would be tempered by a reduced differential between traditional fuels and gas prices. The government is working towards addressing these issues in order to increase the demand for electric vehicles.

Government’s Continuous Push along with New Model Launches to Drive EVs Forward

There is a growing thrust on the adoption of electric vehicles (EVs) across the globe amid increasing carbon emissions which have serious repercussions including global warming.

The Indian government is aligned with taking steps to decarbonize the economy with a push towards electrification of mobility. As India is significantly dependent on crude oil imports and various cities in India are facing pollution menace, the Indian government has also acknowledged the need to promote EVs.

The Government’s initiatives along with growing concerns for environment & energy security, rapid advancements in technologies for power train electrification, and innovative newer business models are driving the sales of EVs.

The Government has taken various initiatives to support EV adoption in India. In the Union Budget 2023-24, the government has allocated Rs. 35,000 crores in order to achieve the energy transition, energy security and net zero objectives, which will help the EV industry.

India is planning to achieve 100% e-mobility by 2030 in smart cities and this opens up a huge market for EVs. PLI schemes has also been announced to assist the development of technology adoption that are currently low in India, and it can be used in collaboration with schemes for advanced chemistry cells (ACC).

The industry received good government backing over the last few years to increase EV penetration in India. Smart City Mission, is an urban renewal and retrofitting program by the Government of India with the mission to develop 100 cities across the country making them citizen friendly and sustainable.

EVs are the solution for both better quality of life and reduction in environmental footprint and hence EVs will be integrated as part of smart city transportation. Smart mobility solutions are a must as it not only helps in a better quality of life but also help in reducing its environmental footprint.

The industry has received good government backing over the last few years to increase EV penetration in India. As the EV market is growing exponentially in India, vehicle manufacturers are gradually inclined to manufacture more electric-run vehicles.

A few major players in the EV market include Hero Electric, Ola Electric, Ather Energy, Tata Motors, Mahindra Electric, TVS Motors, Hyundai, and MG Motors.

However, other key players have announced plans to produce additional EV models fit for the Indian market in the future, thereby increasing market rivalry and boosting adoption. This massive shift to electric mobility in India made a tremendous impact on EV manufacturers in India.